PV: A Pillar of National Energy Security

In late February 2025, First Solar filed a patent infringement lawsuit in the United States against China’s leading photovoltaic (PV) companies, citing its US09130074 patent. The lawsuit serves as a wake-up call for the industry.

The case targets TOPCon solar cell technology, which is widely adopted in China and accounts for a significant share of global PV exports.

If First Solar expands its patent enforcement globally, the consequences could be severe. Chinese PV enterprises would face substantial losses, and the industry’s security would be at serious risk. The potential impact could even surpass that of previous patent disputes in China’s semiconductor sector. In an extreme scenario, a wave of global patent lawsuits could cripple the Chinese PV industry, echoing the setbacks experienced by the semiconductor sector. Decades of technological advancements could be undone overnight.

This lawsuit sends a clear warning to China’s PV industry, highlighting the urgent need to enhance its security.

Lessons from China’s Semiconductor Industry

The patent blockade imposed on China’s semiconductor sector caused serious impact. Its impact can be categorized into five major challenges:

- Restricted Technology Pathways and Rising Costs: Global tech giants hold 80% of key patents in lithography, electronic design automation (EDA), and other critical areas. Chinese firms face a “patent thicket,” forcing costly workarounds and delaying technological upgrades. For example, the research and development (R&D) cost for China’s 14nm chip once exceeded those of global competitors by 30%.

- Limited Access to Advanced Technologies: Foreign firms establish technology alliances through cross-licensing agreements, restricting China’s access to cutting-edge manufacturing tools. ASML’s extreme ultraviolet (EUV) lithography machines, which incorporate over 100,000 patents, have significantly hindered China’s progress in sub-7nm chip production.

- Limited Market Expansion: U.S., Japanese, and Korean companies leverage their patent advantages to impose high licensing fees, adding 15%-20% to the cost of Chinese semiconductor exports. This significantly weakens price competitiveness. In 2022, Chinese firms faced a 68% defeat rate in international semiconductor patent lawsuits.

- Heightened Supply Chain Risks: Japanese and U.S. firms hold 90% of patents in critical semiconductor materials. Japan’s JSR Corporation controls 76% of the global photoresist market, while China’s domestic material self-sufficiency remains below 20%.

- Hindered International Collaboration: Since the enactment of the U.S. CHIPS and Science Act, China’s participation in international semiconductor R&D projects has dropped by 42%. Its influence in global standard-setting has fallen by 15 percentage points.

TOPCon solar cell technology faces a U.S.-led patent infringement lawsuit whose potential impact may surpass that of semiconductors. The TOPCon technology, which is the subject of the lawsuit, accounts for a significant share of the global PV market. If the U.S. expands its patent enforcement globally, China’s PV industry could suffer the same fate as its semiconductor sector.

First Solar Sues China’s Leading PV Companies Over Alleged TOPCon Core Structure Patent Infringement

TOPCon technology’s core structural patents are primarily owned by TetraSun and LG. In 2013, First Solar acquired patents US09130074 and US09666732 from TetraSun. In 2022, several leading Chinese PV companies obtained licensed patents US09722104 and US10230009 from LG.

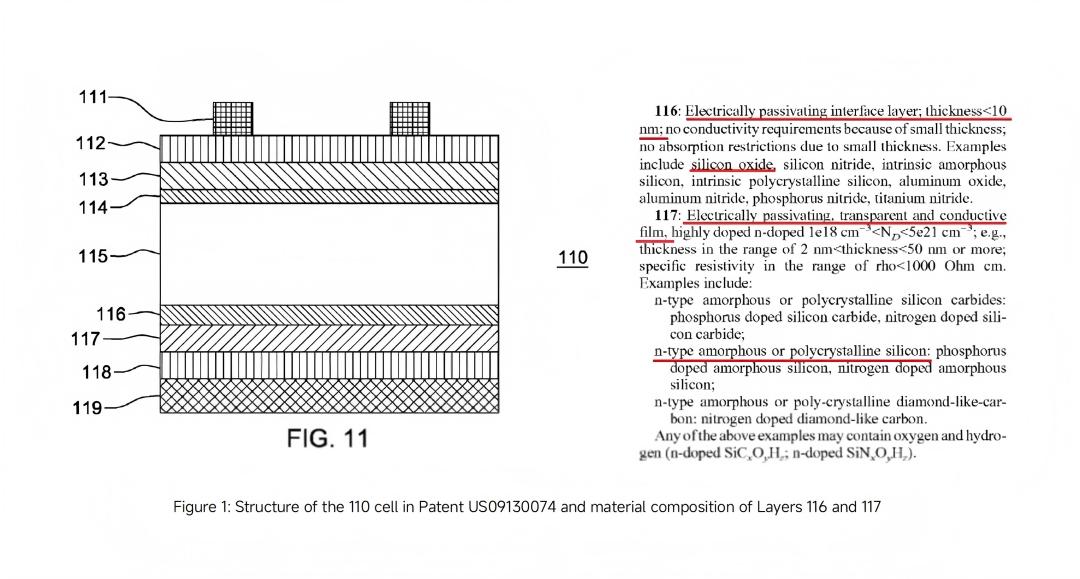

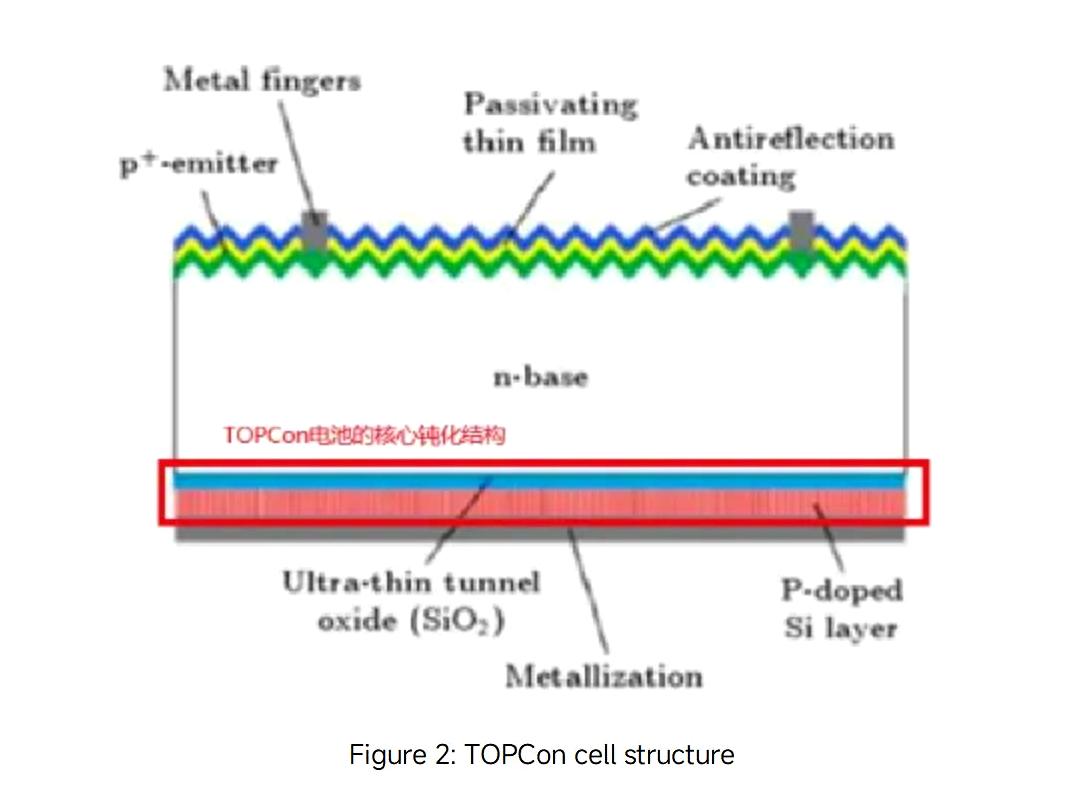

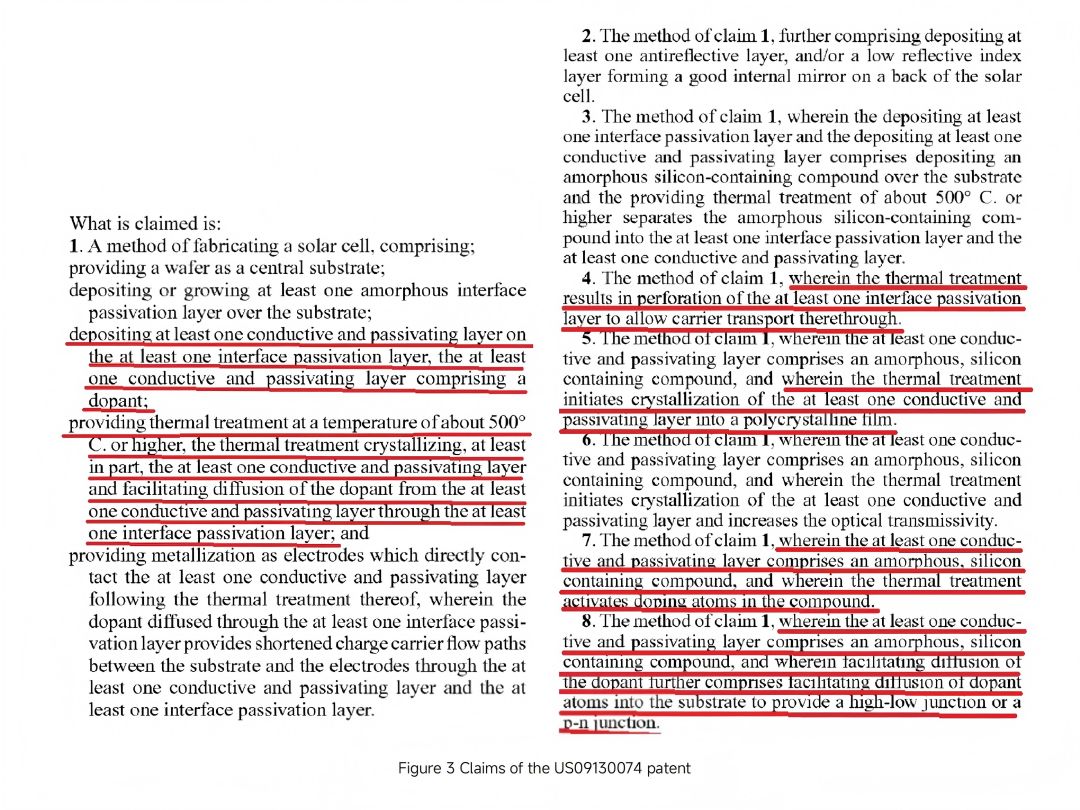

According to a report by SOLARZOOM, First Solar has filed a patent infringement lawsuit against top Chinese PV manufacturers, citing patent US09130074, which outlines 13 types of solar cell structures. One of these, the "110 cell," features a wafer type and PN junction closely resembling TOPCon technology: a P-type front, N/P wafer, and N-type rear. The 110 cell’s core layers—116 and 117—include a silicon oxide-based passivation layer and an N+ polysilicon-based passivation and transparent conductive layer. These constitute the very core structure of TOPCon cells. As shown in the diagram below:

First Solar’s US09130074 patent differs from TOPCon cell structures in some aspects:

- The 110-cell design incorporates a transparent conductive film on both surfaces instead of the insulating anti-reflective layer found in TOPCon cells.

- The structure of the 113 and 114 layers in the 110-cell is reversed compared to TOPCon technology.

However, the US09130074 patent explicitly states that the solar cell structures described—including substrates, conductive layers, anti-reflective coatings, passivation layers, and electrodes—are not mutually exclusive. Any of these structural features may be applied across different designs covered by the patent. The patent’s claims cover any interface passivation layer with a conductive passivation layer containing at least one doping element. It also references tunneling layers for carrier transport, polycrystalline silicon conductive passivation layers, and thermal processing above 500°C after doping that are the core structures and production methods of TOPCon’s backside passivation structure. (For details, refer to the link at the end.)

This suggests that, despite Chinese companies obtaining LG’s patented technology, their TOPCon cell designs may still infringe on First Solar’s US09130074 patent.

Currently, First Solar’s lawsuit is focused on the U.S. market, but its patent has been granted in multiple countries and regions. It could expand litigation globally. The following licensed markets together account for about 70% or more of the global PV market:

According to SOLARZOOM, First Solar’s US09130074 patent, originally acquired from TetraSun, remains valid until 2030. If an extensive patent dispute unfolds, companies may struggle to withstand a prolonged legal battle, raising concerns over the industry’s stability.

Solar Cell Technology Faces Patent Bottleneck

China’s leading solar cell technologies—TOPCon, HJT, and BC—are advancing beyond PERC technology.

According to SOLARZOOM, in 2024, these three technologies accounted for 92.68%, 5.87%, and 1.45% of large-scale central SOE projects, respectively.

TOPCon technology, an upgrade from traditional PERC cells, offers higher efficiency. Despite concerns over UV degradation and bifacial rate, it was rapidly popularized in a short time, its capacity was rapidly expanded, and it captured a significant market share, with products available all over the world.

BC technology faces patent risks. Maxeon inherited BC technology base patents from SunPower, covering IBC core structures. Some Chinese firms using similar designs, such as full-back-contact electrodes, could face infringement lawsuits. A recent Maxeon case in Germany highlights the difficulty of circumventing BC-related patents. Although some Chinese companies claim independent innovation, their designs derive from still-active foreign patents, making them vulnerable to licensing requirements or invalidation risks. Ignoring these patents while aggressively pushing products may lead to export restrictions or hefty legal damages.

HJT Emerges as Key Battleground in U.S.-China PV Competition

From a patent risk perspective, HJT technology is the safest PV cell technology at present, and it is also the core technology to ensure the safety of China’s PV industry.

Originally developed and applied for a core patent by SANYO (later acquired by Panasonic) in 1990, its patents covered HJT cell basic structures, including amorphous and crystalline silicon integration and passivation techniques. However, these patents expired in 2015, allowing companies free use of HJT’s foundational framework without licensing fees.

According to SOLARZOOM, in 2024, China’s HJT modules secured 13.56 GW in large centralized state-owned enterprises (SOE) set procurement; the total winning capacity reached 13.56 GW with an increase of 333.02%. HJT technology accounted for 5.87% of all domestic PV project procurement.

The United States is ramping up HJT investments. SOLARZOOM reports that more than seven U.S. firms—including Meyer Burger, Solarix, NuVision Solar, Revkor Energy, H2 Gemini, Enel, SPI Energy, and Canadian Solar—have already committed to HJT production. The total planned and operational HJT capacity in the U.S. now exceeds 33.7 GW. Multiple American PV companies have stated that HJT will be the next-generation solar technology in the U.S. market.

Energy security remains a top priority for China. As one of the country’s core renewable industries, PV technology plays a critical role in safeguarding national energy security. Undergoing the most profound and unprecedented changes in a century, China must win this battle—failure is not an option.

China Strengthens IP Protection to Safeguard PV Industry Security

In the last two years, as overseas patent challenges in PV escalate, China is intensifying efforts to protect intellectual property (IP) rights. In 2023, the China National Intellectual Property Administration (CNIPA), alongside nine government departments, issued the Several Measures on Advancing Intellectual Property Empowerment in Key Industrial Chains (2023). This notification called for the establishment of patent pools in strategic sectors like PV, encouraging patent sharing and collaborative innovation. In 2024, China introduced the Opinions on Strengthening Intellectual Property Protection, which further detailed the system of punitive damages and behavioral preservation. The government has imposed a stricter judicial crackdown on infringement, and the cap on the amount of compensation for infringement has been raised to five times the actual damages. The Ministry of Industry and Information Technology (MIIT) revised the Photovoltaic Manufacturing Industry Standard Conditions (2024 Edition), integrating IP protection into market entry requirements for the first time. PV companies must hold core patents relevant to their primary business and maintain a clean IP record for the past three years. The regulation also tightens controls on misleading technology claims, pushing firms to strengthen independent technology R&D. It focuses on requirements to improve technical indicators, strengthen quality management and intellectual property protection, prohibit the technology that does not meet the conditions from expanding, and so on. People can see China's emphasis on self-control of advanced PV technology. To secure industrial safety, China's PV sector must prioritize patent compliance and accelerate the development of 100% self-sufficient solar technology. Only then can the industry maintain control over its future and serve as a pillar of national energy security.

(First Solar Patent Original Text: http://m.solarzoom.com/article-191451-1.html)